Teaching teens and young adults how to save and invest is a great way for them to learn good financial money habits.

A child under age 18 cannot sign legal documents or open a savings or brokerage account. However, parents can open a bank account and brokerage account for their child and when a child reaches age 18 or 21, he or she can take ownership of the account.

Open a custodial account sometimes called Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts. These accounts will be in the parent’s name but your child can take full control of it once he or she reaches age 18 or 21, depending on state laws.

Saving Vs Investing

There’s a difference between saving and investing.

Saving means storing money in a bank account. The bank may provide interest on the savings account where the bank pays you for holding your money at the bank.

Investing means taking on risk and buying an asset that will increase in value and provide you with a return on your money over time.

Saving in 2021

Savings account interest rates have plummeted over the years and money saving wisdom that worked in the 1980s and 1990s has to be updated. Teaching your kids to save up in a savings account is not enough, especially when bank account interest rates are less than 0.5%.

In fact, after accounting for inflation, money sitting in a bank account is losing purchasing power. If your money is earning 0.5% and inflation is 6%, you’re losing 5.5% by letting your money sit in the bank!

Investing your money in assets such as stocks allows it to grow. The average stock market return is about 10% per year. Even accounting for inflation, your money continues to grow.

That same $1,000 invested with an annual growth of 10% would be $2,593.74 after 10 years.

What should you invest in?

Investing in Single Companies

You can buy stock in a single company. Let’s use Apple (Symbol: AAPL) as an example. If the company does well, the stock price goes up and so does the value of your investment. If the company has bad news (such as poor sales of iPhones or a country stops selling Apple products), the stock price could go down and so does your investment.

Individual stocks are risky. Some companies might be really good investments at one time but then the company fails to innovate or falls behind competitors and can even go bankrupt. For instance, Eastman Kodak was a leader in photography and film but it failed to innovate embrace digital photography. The company never recovered since. If you invested in Eastman Kodak, once a great company, you probably lost your money if you held onto the investment.

Investing in “the Market”

Instead of buying an individual company, you can diversify and spread your risk across many companies by buying an ETF or exchange traded fund. An ETF is similar to a share of stock but you are investing in the market as a whole rather than picking individual companies.

Buying a single company is very volatile. The stock price can go up and down. By buying an ETF, you’re invested in many companies and movement tends to be less volatile.

As a new investor, don’t try to pick a winner but invest in the broad market. Historically, the stock market returns 10%. Some years, it’s more and some years it is less.

Don’t try to time the market. Even the experts cannot predict when the market is at a peak or when there’s a bottom. What’s important is the time IN the market rather than buying at the bottom and selling at the top.

Steps to Investing

- Start by opening a savings account. If you don’t have one already, open a savings account. Ask your bank to open a custodial savings account and include your child’s name. Find a bank with no account minimum deposits and no fees. Deposit money into this account.

- Open a brokerage account. Again, open a custodial brokerage account and use the savings account and transfer the funds to your brokerage account. Once the funds transfer, you can buy stocks and ETFs.

There’s many discount brokerages out there. Look for one without minimum deposits, no account management fees, and no trading fees. Nowadays, brokerage firms have eliminated commissions on trades but make sure you choose a brokerage firm that doesn’t charge you for investing.

Some suggestions are:

- Once your funds have transferred to your brokerage account, you can start investing.

You can invest in anything you like but I suggest starting your portfolio with an ETF that represents the Total US Stock Market.

In particular, I like Vanguard Total Stock Market ETF (Symbol VTI).

VTI shares trade daily and the price fluctuates.

As an example, on 11/26/2021, VTI was trading at $236.73.

That means, it will cost you $236.73 for each share of VTI which allows you to own a small sliver of all US Based Market companies.

That’s it. You are now invested.

Some additional tips:

Continue to buy more shares and let your gains and dividends compound and grow over time. Your position will continue to grow as long as you don’t sell. The more you invest, the more your investment can grow.

You don’t need to watch your investment every day. In fact, the value of your investment in the short term might go up and down. In the long term, your investment will grow.

$1,000 initial investment; After 20 years at 10% growth: $6,727.50

$1,000 initial investment; But add $50 per month for 20 years at 10% growth: you’ll have $41,092.50

Getting Started with Charles Schwab.

The following is a step by step guide on funding your Charles Schwab brokerage account:

What to do after opening your account

Log in with your account user name and password.

Click accounts and link to your savings or checking account.

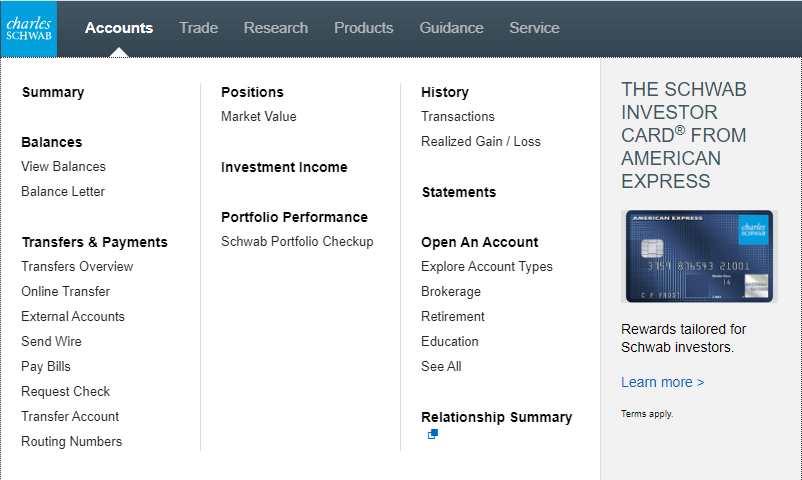

Go to “Accounts” and click “external accounts”

Click “Link an External Account” to connect to your Savings or Checking Account. If your bank doesn’t have a login, you can verify using trial deposits where Charles Schwab puts a few cents into your savings or checking account and you look to see what these deposits were and verify the deposit amounts to link to your account. Logging in via your bank is quicker to set up your external account link than trial deposits, which can take a few days.

Once your external account has been linked, transfer the amount of money that you’d like to invest.

Go to Accounts… Online Transfer…Cash Only. And select your bank account in the FROM category and your Charles Schwab Account in the TO category. Transfers can take a few days.

Once the money transfers in a few days, you should see it by going to Accounts…Summary.

Trading (Buying and Selling Stocks/ETFs)

Go to Trade…. Trade Stocks

You’ll get a screen similar to the one below.

At the top of the screen, you’ll see how much cash you have available to trade.

Under Symbol, type “VTI”

Action: Buy

Quantity: Figure out how many shares you want to buy. Take your total cash available and divide ty the current price.

In the following picture, VTI – Vanguard Total Stock Index Fund is trading at $235.99. The Ask is $234.87 and the Bid is $234.57.

You’ll need at least $235.99 to purchase a share but it makes sense to have more cash in your account just in case the price fluctuates as you are buying. So have $250 in your account to buy 1 share.

If you have more than $250, you might be able to buy multiple shares.

Let’s say you had $1000. $1,000/$235.99 = 4.237 shares (rounded down) = 4 shares.

With $1000, you’d be able to purchase up to 4 shares of VTI.

Order Type: Use Market Order (but there are options to choose from)

- Market Order – guarantees execution but not the price. Buy orders execute at the “ask” price and sell orders will execute at the “bid” price. Note that the price can move as you are executing your trade so your current quote and execution price can be different.

- Limit order – A request to buy or sell a security only at the price you specify.

- Stop Order – An order to buy or sell at the market price once a security is at or has traded through a certain price (the Stop price).

Also, click reinvest dividends. By doing so, instead of getting a cash payout for your dividends, your dividends paid to you will be reinvested into additional shares. This allows you to continue to grow and compound your investment.

Once everything looks good, click review order.

Then verify all your order details. Advance to the next screen and submit your order.

Congratulations, you now own share (or more) of VTI and are invested in the market.

Disclaimer: I am not a financial advisor and this blog is for entertainment purposes only and is not investment advice. Reach out to a tax attorney, Certified Public Accountant (CPA) or professional financial advisor for investment advice.